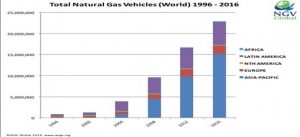

By August 2017, there were more than 24 million Natural Gas Vehicles (NGVs) operating worldwide, with a trajectory of global natural gas vehicle increase from 1996 to 2016. Asia-pacific region is well ahead to lead the NGVs development, followed by Latin America, and Europe. Even though natural gas in North America has the cheapest price in the world, the development of NGVs in North America is extremely slow (Figure 1). In this write up, author tries to look into the economic and political reasons behind, analyzing the data of US and China.

Figure 1: Global Natural Gas Vehicle Development

The United States has been seeking alternative transportation fuel supplies since the Arab Oil Embargo in 1973. After more than a 40-year of struggle, petroleum remains the predominant player in the transportation sector. The shale gas boom in North America makes natural gas likely a diesel substitute to power the transport sector in the form of compressed natural gas (CNG) and liquefied natural gas (LNG).

Vehicles like tractors, account for 23% of HDVs (Heavy Duty Vehicles) sales in the US but are responsible for roughly two-thirds of diesel consumption. Many energy companies seek the transition opportunity from oil to natural gas in the transportation sector for cheap and clean energy.

Royal Dutch Shell is one of the front runners on the development of LNG for HDVs in North America. Shell opened its first LNG refilling station in Calgary in 2013 as part of its plan to build Canadian Green Corridor in western Canada. Three years later, the same LNG station was demolished due to lack of market demand (Figure 2). The development of LNG for road transportation business is in stall condition across North America.

Figure 2:(Left) Shell built its first LNG refueling station in Canada in 2013; (Right) The same LNG station was demolished in 2016

Why Natural Gas Vehicle, as well as LNG vehicles, didn’t get a booming market in North America as its fast development in Asia or Latin America (Figure 1)?

This could be due to the following reasons:

- Cheap diesel price

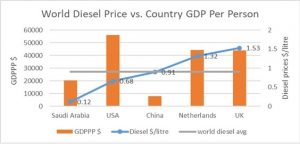

Generally, richer countries have higher prices while poorer countries and the countries that produce and export oil have significantly lower prices. The differences in prices across countries are due to the various taxes and subsidies for diesel. However, USA is an exceptional case due to the fact that it is an economically advanced country with high GDP per capita but has low diesel prices.

Figure 3: Country GDP per Capita vs. Diesel Price (http://www.globalpetrolprices.com/) by the week of Feb-20-2017.

Figure 3 shows the diesel price verses the country’s GDP per capita in Saudi Arabia (oil exporting country), the USA, the UK, the Netherlands (developed countries) and China (developing country).

Even though the GDP per capita in the USA is five times higher than in China, its retail diesel price is only $0.68/liter, lower than diesel price in China at $0.91/liter (also world average), and only half the diesel price in the Netherlands and the UK. The lower diesel price in the US is possibly a result of low tax or high subsidy from government policy, which discourages the transition from a diesel fuel framework to any other new or clean form of energy.

2. Expensive CNG/LNG retail price

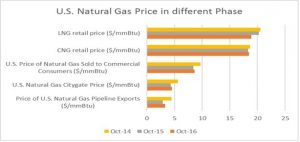

Figure 4:Natural Gas Price in USA (data source from EIA; CNG and LNG retail price from www.afdc.gov)

It is well known that the natural gas price in North America is low due to the shale gas boom in recent years. However, the US natural gas price is normally referred to Henry Hub pipeline export price, not the commercial or retail natural gas price on the US market.

The price of natural gas to domestic commercial consumers (e.g. CNG/LNG users) was around $9/mmBtu in 2016, which was three times higher than the pipeline export price at $3/mmBtu. The retail LNG price on the US market in 2016 was even higher than $20/mmBtu. With the diesel price at only $0.68/litre (equivalent to $20/mmBtu), there was basically no economic driver for LNG to replace diesel fuel in the transportation sector.

3. Price difference between diesel and LNG is the economic driver

Even though the natural gas price from the US is three times higher than the price in China on the global natural gas market, the domestic commercial natural gas price in the US is on the par to the commercial gas price in China (Figure 5). The large diesel/LNG spread is the economical driver to promote LNG vehicle adoption. It is no surprise that LNG refueling stations are demolishing in the United States while those in China are booming even at the same global crude oil price.

4. Government policy matters

Vehicle exhaust fumes from petroleum fuel, especially diesel, cause GHG emissions and high levels of air pollution. HDVs, even with just a 7% share of global vehicle stock, due to their large engine size and consumption of diesel fuel, accounted for over 40% of NOx emissions and 50% of PM2.5 emissions from the transport sector in 2015. Each county should do its share to reduce oil consumption and improve the share of natural gas in the mix energy consumption.

The progress of using LNGVs to replace HDVs is heavily dependent on the diesel/LNG spread price, but government policy can make a difference to both the diesel and LNG price through tax or other incentive programs, which impact LNGVs development.

In China, the policy is in place to lower LNG price and encourage natural gas consumption.

In US, the current government does not seem to have the urgency of using clean energy. The low oil price and high LNG/CNG retail price makes it uneconomical for LNG/CNG adoption as a road transportation fuel.

Figure 5:LNG and Diesel Price Comparison in the US and China (data source from EIA, AFDC and Global petrol price in March 2017)

The diesel/LNG conversion is an integrated energy innovation process, which needs government policy to properly guide the development. Government policy support is critical for any emerging new technology at the initial stage for a niche market setup based on its economic driver.

Authored by: Maggie Han

Maggie Han is currently working in Shell as process engineer. She has a wide experience in oil and gas industry, globally, and her work experience spans about 20 years with major players like Shell,BP and Sinopec, China.